Sales Tax Calculator Los Angeles

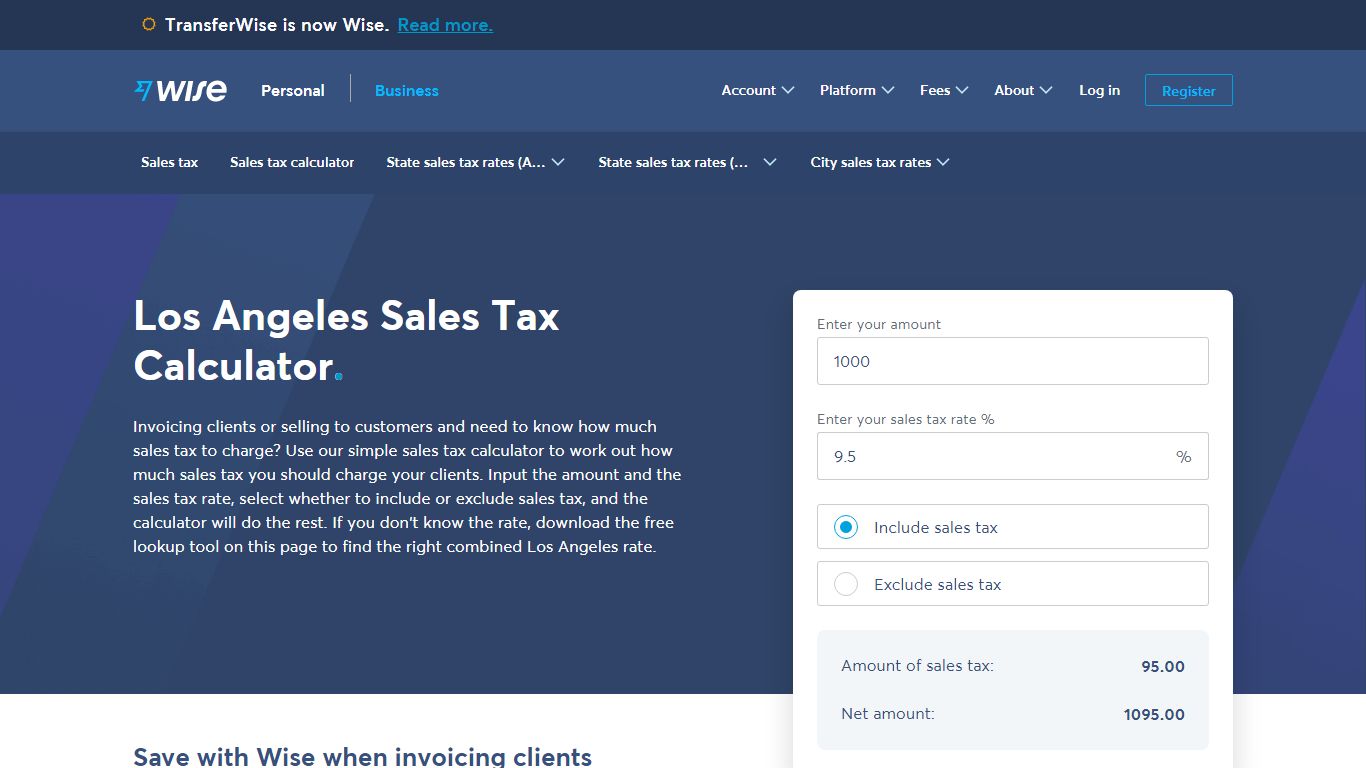

Los Angeles Sales Tax Rate and Calculator 2021 - Wise

To calculate the amount of sales tax to charge in Los Angeles, use this simple formula: Sales tax = total amount of sale x sales tax rate (in this case 9.5%).

https://wise.com/us/business/sales-tax/california/los-angeles

Los Angeles, California Sales Tax Calculator - Investomatica

Enter an amount into the calculator above to find out how what kind of sales tax you'll see in Los Angeles, California. You'll then get results that can help provide you a better idea of what to expect. 9.52% Average Sales Tax Summary The average cumulative sales tax rate in Los Angeles, California is 9.52%.

https://investomatica.com/sales-tax/united-states/california/los-angeles

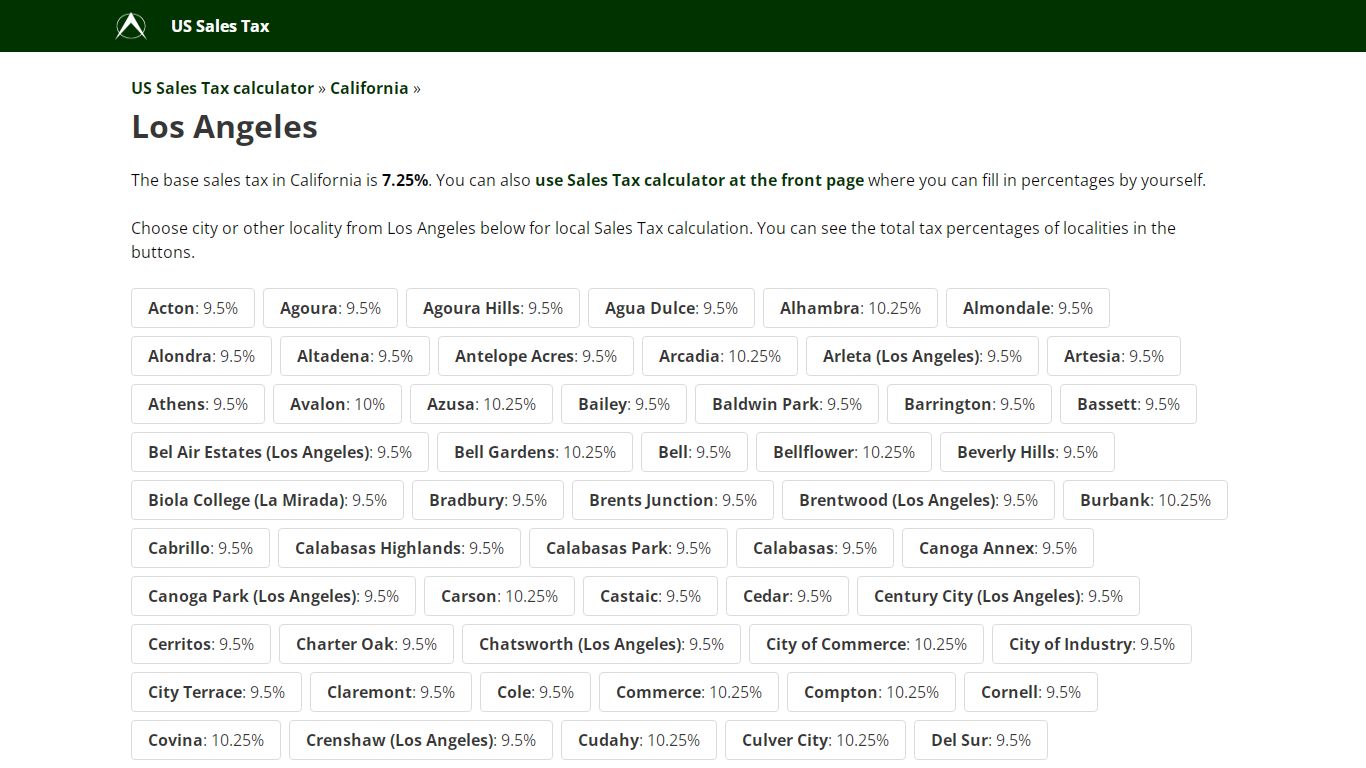

Los Angeles Sales Tax calculator, California, US

US Sales Tax calculator » California » Los Angeles The base sales tax in California is 7.25%. You can also use Sales Tax calculator at the front page where you can fill in percentages by yourself. Choose city or other locality from Los Angeles below for local Sales Tax calculation. You can see the total tax percentages of localities in the buttons.

https://vat-calculator.net/us-sales-tax/california/los-angeles

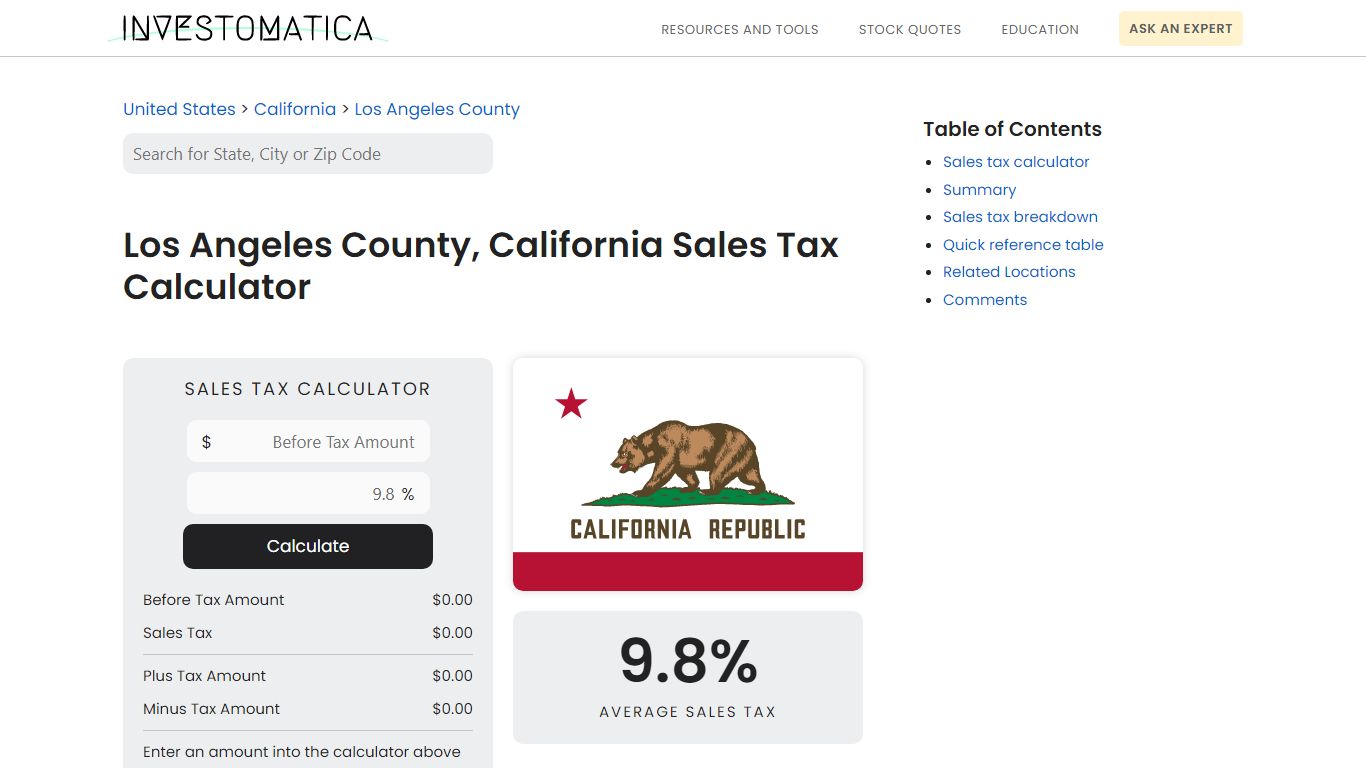

Los Angeles County, California Sales Tax Calculator (2022)

Sales Tax Calculator Before Tax Amount $0.00 Sales Tax $0.00 Plus Tax Amount $0.00 Minus Tax Amount $0.00 Enter an amount into the calculator above to find out how what kind of sales tax you'll see in Los Angeles County, California. You'll then get results that can help provide you a better idea of what to expect. 9.8% Average Sales Tax Summary

https://investomatica.com/sales-tax/united-states/california/los-angeles-county

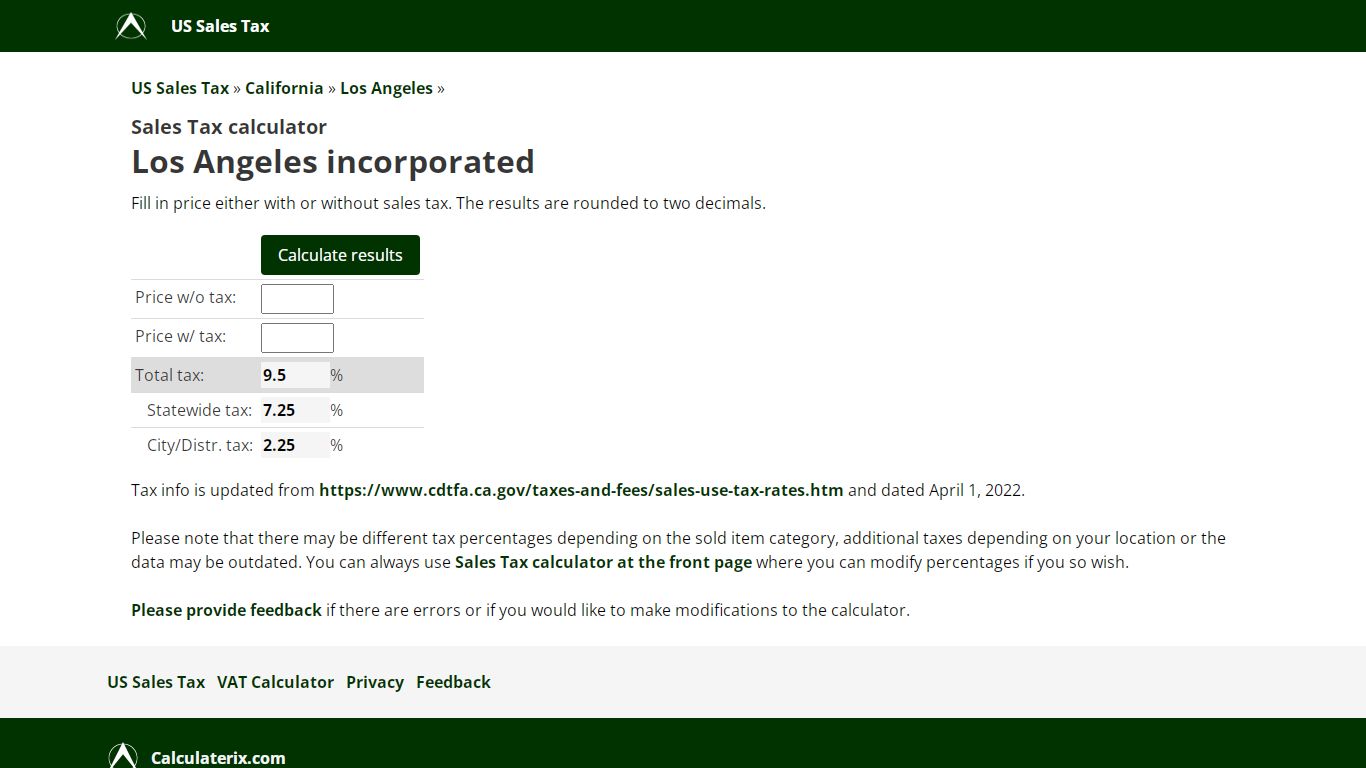

Los Angeles incorporated Sales Tax calculator, Los Angeles, California, US

US Sales Tax » California » Los Angeles » Sales Tax calculator Los Angeles incorporated. Fill in price either with or without sales tax. The results are rounded to two decimals. Price w/o tax: Price w/ tax: Total tax: % Statewide tax: % City/Distr. tax: %

https://vat-calculator.net/us-sales-tax/california/los-angeles/los-angeles

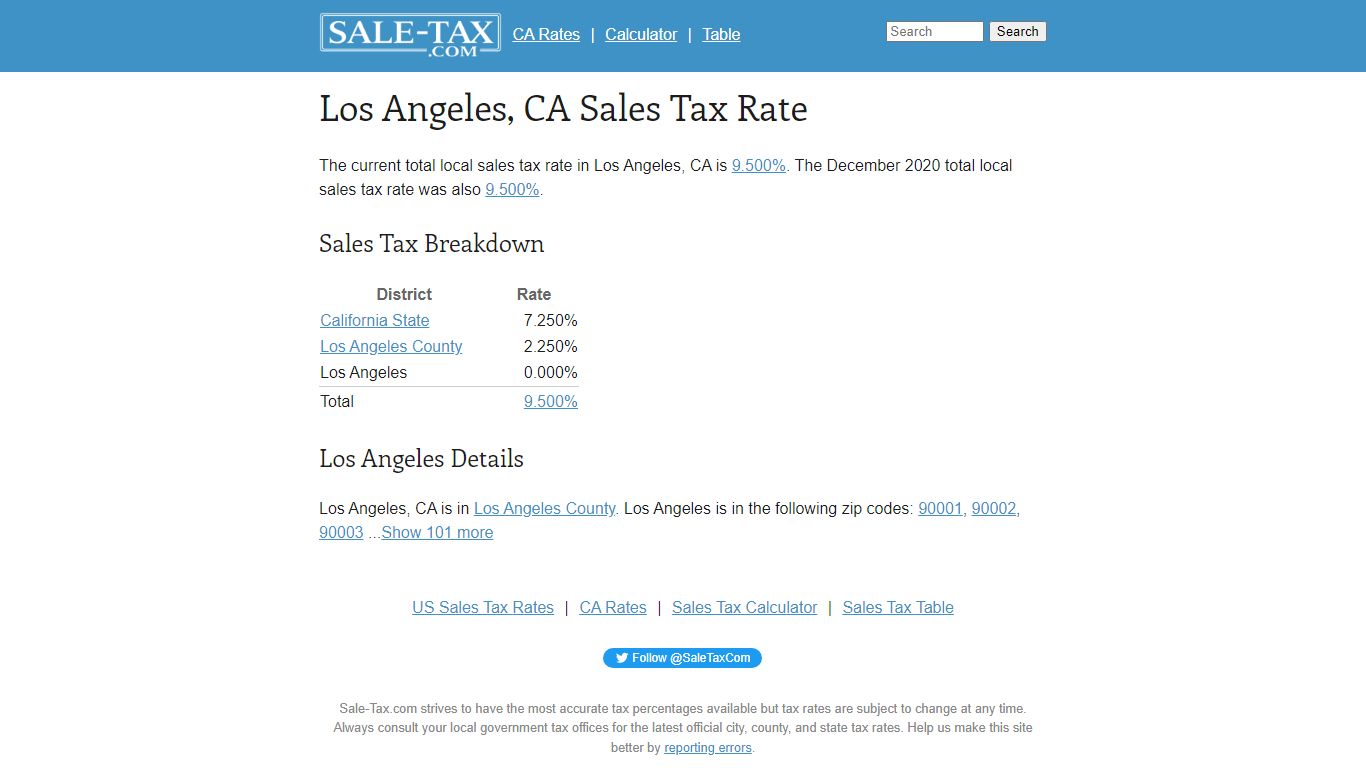

Los Angeles, CA Sales Tax Rate - Sale-tax.com

Los Angeles, CA Sales Tax Rate The current total local sales tax rate in Los Angeles, CA is 9.500% . The December 2020 total local sales tax rate was also 9.500% . Sales Tax Breakdown Los Angeles Details Los Angeles, CA is in Los Angeles County . Los Angeles is in the following zip codes: 90001, 90002, 90003 ... Show 101 more

https://www.sale-tax.com/LosAngelesCA

The Los Angeles County, California Local Sales Tax ... - SalesTaxHandbook

California has a 6% sales tax and Los Angeles County collects an additional 0.25%, so the minimum sales tax rate in Los Angeles County is 6.25% (not including any city or special district taxes). This table shows the total sales tax rates for all cities and towns in Los Angeles County, including all local taxes.

https://www.salestaxhandbook.com/california/rates/los-angeles-county

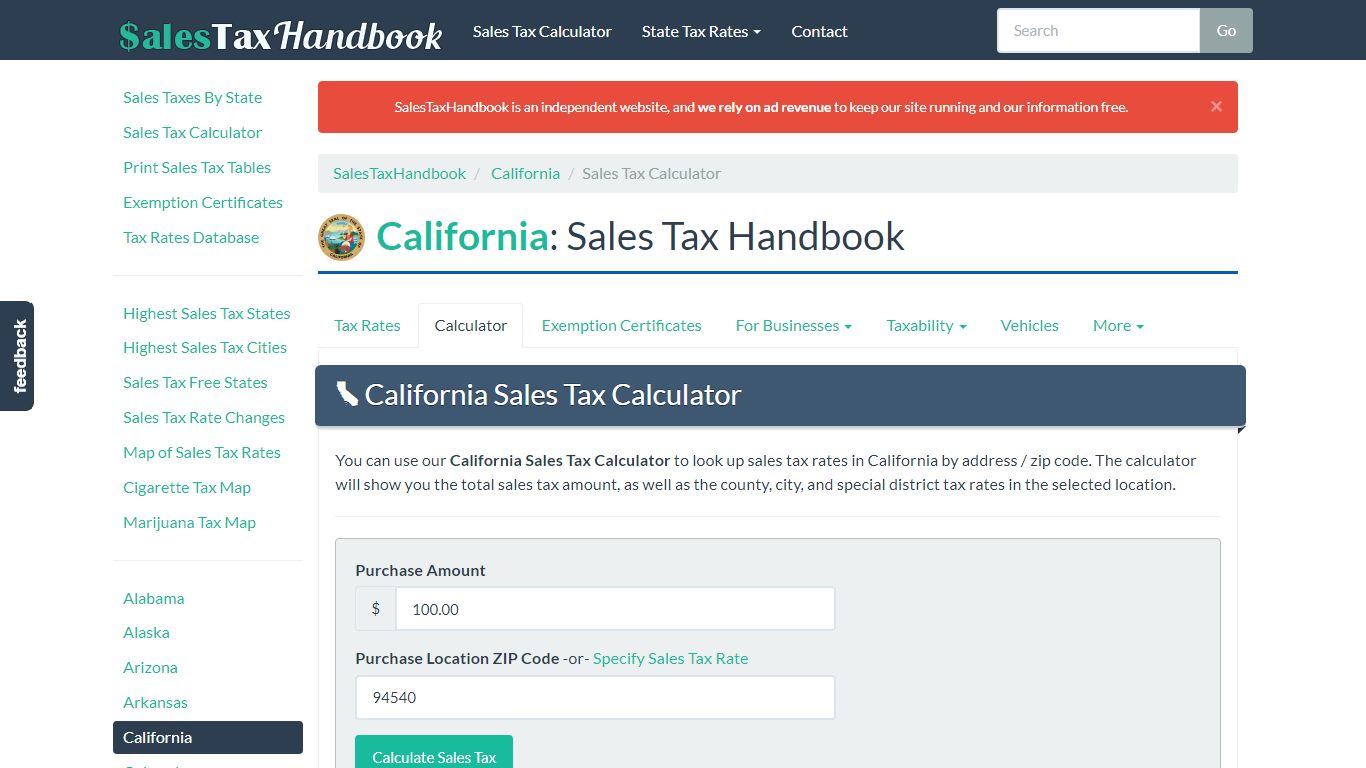

California Sales Tax Calculator - SalesTaxHandbook

California Sales Tax Calculator You can use our California Sales Tax Calculator to look up sales tax rates in California by address / zip code. The calculator will show you the total sales tax amount, as well as the county, city, and special district tax rates in the selected location. Purchase Location ZIP Code -or- Specify Sales Tax Rate

https://www.salestaxhandbook.com/california/calculator

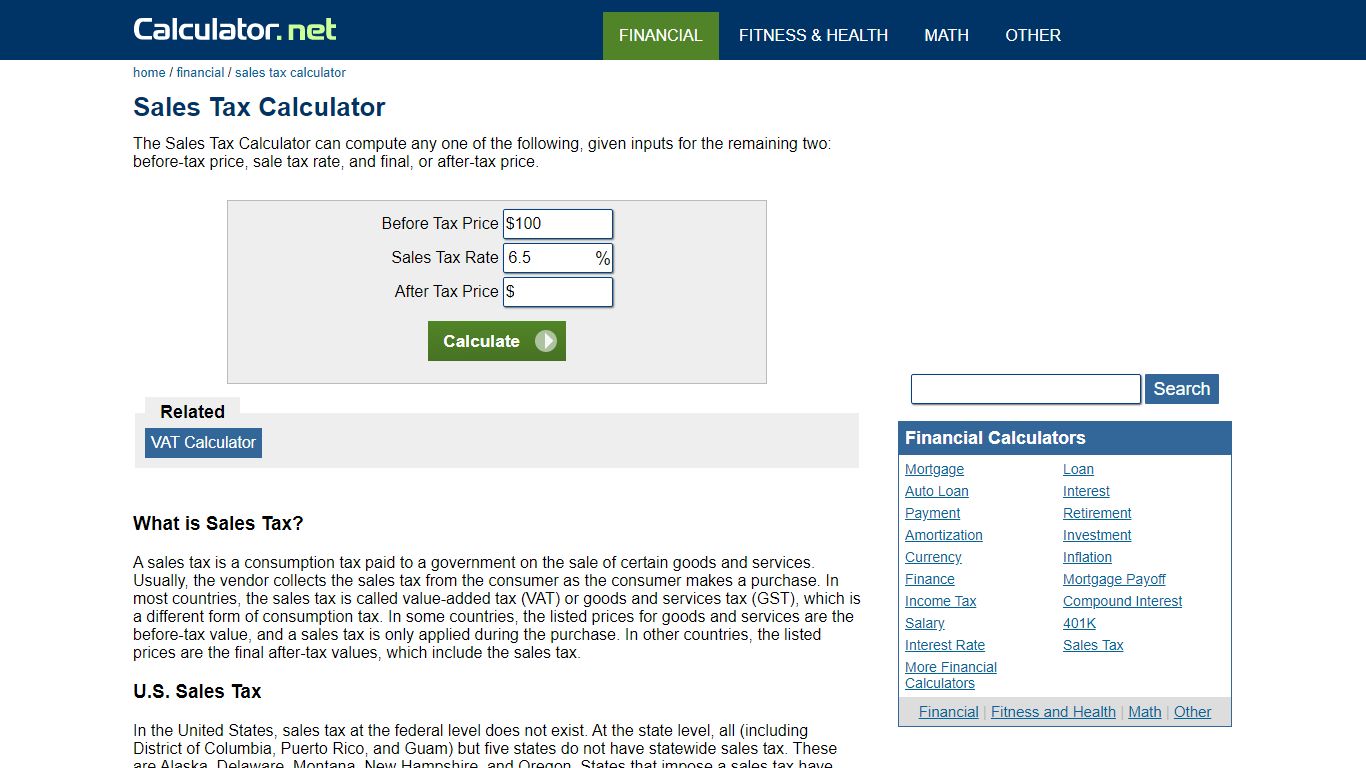

Sales Tax Calculator

The Sales Tax Calculator can compute any one of the following, given inputs for the remaining two: before-tax price, sale tax rate, and final, or after-tax price. Before Tax Price Sales Tax Rate After Tax Price Related VAT Calculator What is Sales Tax? A sales tax is a consumption tax paid to a government on the sale of certain goods and services.

https://www.calculator.net/sales-tax-calculator.html

California City and County Sales and Use Tax Rates - CDTFA

California City & County Sales & Use Tax Rates (effective April 1, 2022) These rates may be outdated. For a list of your current and historical rates, go to the California City & County Sales & Use Tax Rates webpage. Look up the current sales and use tax rate by address Data Last Updated: 4/1/2022

https://www.cdtfa.ca.gov/taxes-and-fees/rates.aspx